Apple Credit Card: Everything You Need to Know

Jun 15, 2024

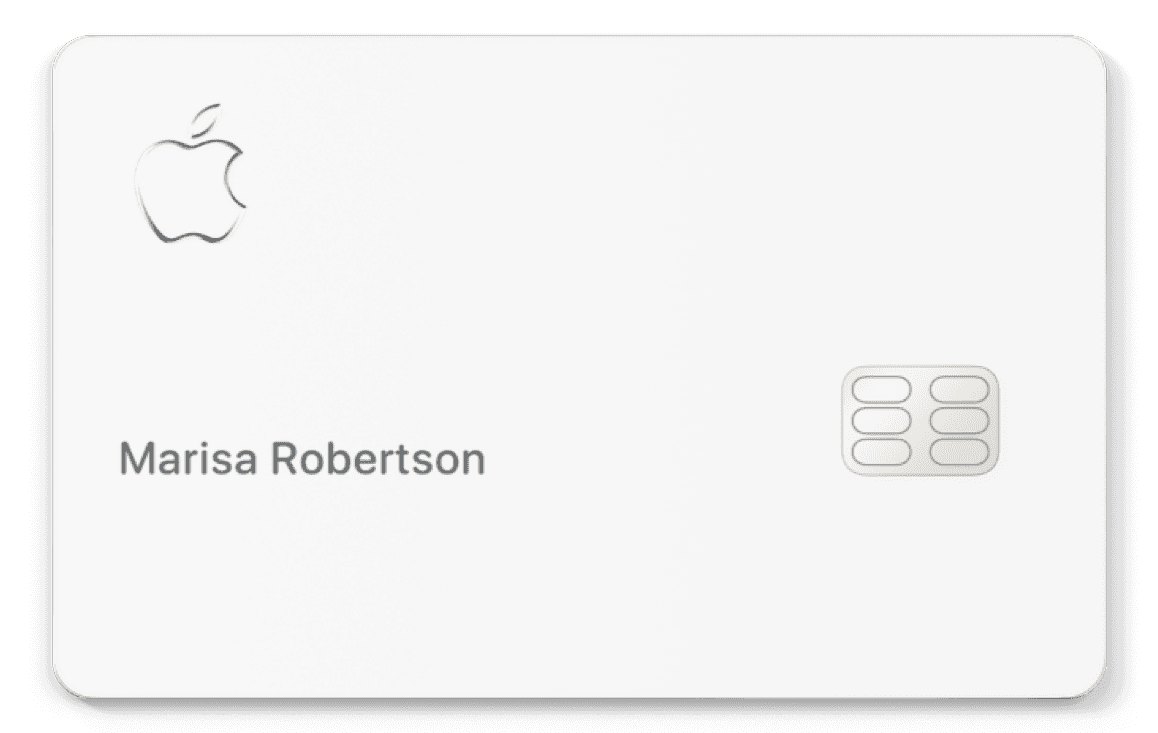

Looking for a modern, tech-savvy credit card? The Apple Credit Card, launched in partnership with Goldman Sachs and Mastercard, offers a seamless integration with Apple devices and a user-friendly experience. Here’s a comprehensive overview of its features, benefits, and potential drawbacks.

Key Features of the Apple Credit Card

Daily Cash Rewards:

3% Daily Cash: Earn on purchases directly with Apple and select partners like Uber, Uber Eats, and Walgreens.

2% Daily Cash: Earn on purchases made with Apple Pay.

1% Daily Cash: Earn on purchases made with the physical card.

No Fees:

No annual, late, foreign transaction, or over-the-limit fees, providing a transparent user experience.

Financial Wellness Tools:

Track spending, categorize expenses, and manage finances through the Wallet app’s intuitive interface.

Privacy and Security:

Secure transactions with a unique dynamic security code for each purchase and protection through Face ID or Touch ID.

Benefits and Perks

Seamless Integration: Apply for the card directly from your iPhone and start using it immediately upon approval.

Instant Notifications: Get real-time alerts for every transaction to monitor your spending.

Flexible Payments: Pay weekly or bi-weekly to manage cash flow and reduce interest costs.

Customer Support: Access 24/7 support via text through the Messages app.

Potential Drawbacks

Limited 3% Cashback Network: The 3% Daily Cash is restricted to purchases with Apple and select partners.

Apple Device Requirement: Best suited for those already using Apple devices, limiting its appeal to non-Apple users.

Conclusion

The Apple Credit Card is perfect for Apple enthusiasts who value convenience, transparency, and robust integration with Apple devices. Its no-fee structure and attractive daily cash rewards make it a competitive choice. However, it’s crucial to assess your spending habits to ensure you’ll fully benefit from the card’s features.

For more insights and details on maximizing credit card benefits, visit Bon for expert advice and tips on financial wellness.